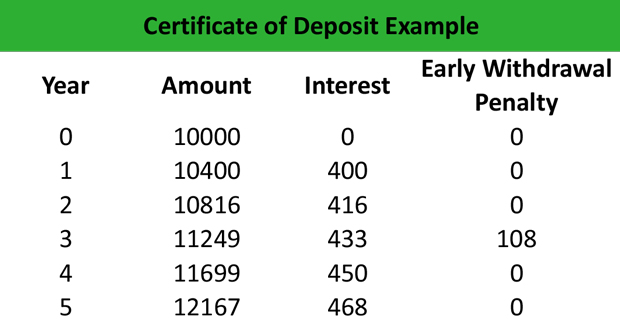

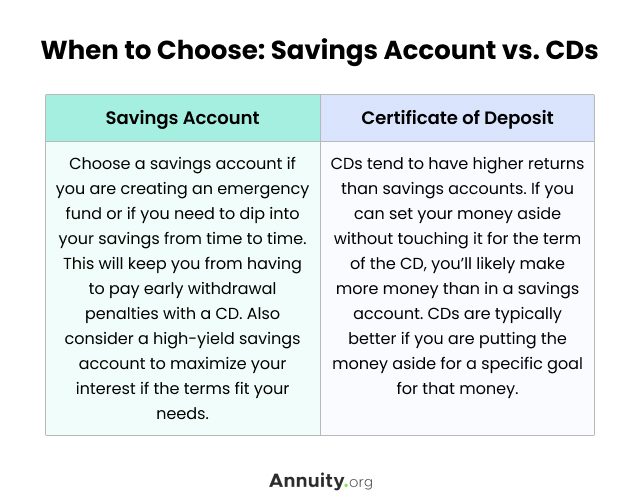

However unlike with savings accounts from which money can be withdrawn at any time the bank expects to keep a CD for a specified time period until maturity. An IRA CD is a CD that is held in a tax-advantaged individual retirement account.

Liquids Assets Definition Examples Importance

Grow Your Savings with The Most Competitive Rates.

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-cbf2392d68a44e7484e66859449cc47c.jpg)

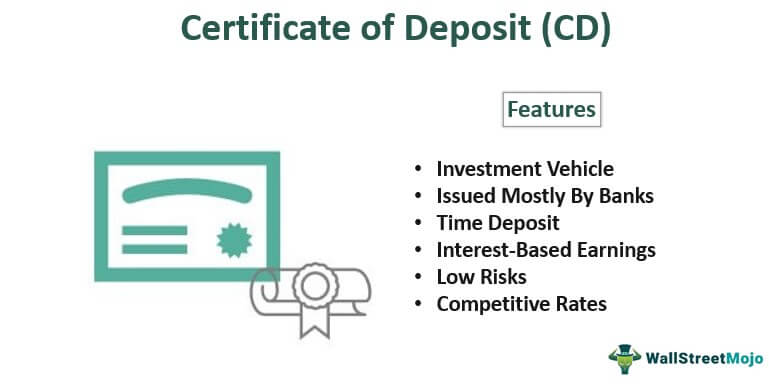

. In general a CDS account can only be opened if the persons are opening it either as a beneficial owner or as an Authorised Nominee. Investors who wish to trade in securities listed on Bursa Malaysia must. A certificate of deposit CD is a bank product that earns interest on a lump-sum deposit thats untouched for a predetermined period of.

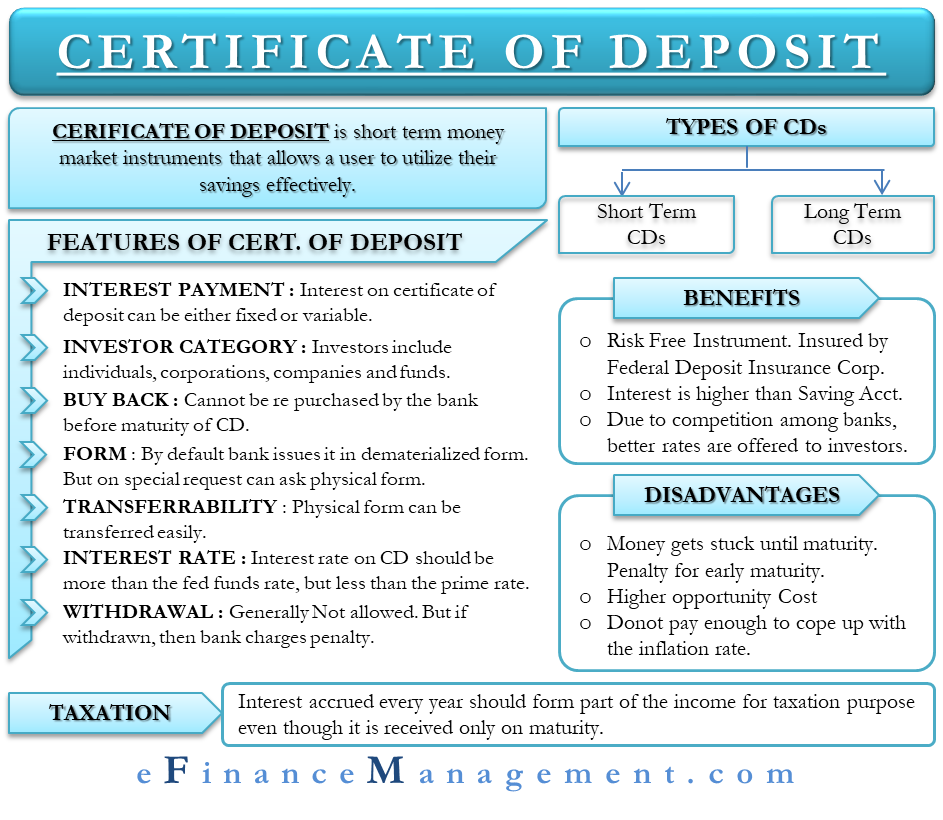

1 In exchange for leaving your money in the account banks offer an interest rate thats usually higher than those offered by a traditional savings account. A CD is an account that typically offers a higher interest rate than a savings or checking account. Certificates of deposit or CDs are fixed income investments that generally pay a set rate of interest over a fixed time period.

CDs like all deposit accounts are insured by the FDIC up to the 250000 legal limit. To understand what that means lets look at the two types of bank accounts that an IRA CD combines. Compare Open Online Today.

What Is an IRA CD. Ad Best High-Yield CD APY Rates. Certificates of deposit with a credit union are insured by the NCUA or National Credit Union Administration not the FDIC.

CDS Account means a central depository system securities account established by Bursa Depository for a depositor pursuant to the Securities Industry Central Depositories Act 1991 and in accordance with the rules regulations guidelines or policies issued by the central depository or Bursa Depository from time to time. Issued by the Federal Deposit Insurance Corporation FDIC and regulated by the Reserve Bank of India the CD is a promissory note the interest on which is. That means the returns are pretty low too.

Quickly Compare Multiple Banks And Credit Unions. The Certificate of Deposit CD is an agreement between the depositor and the bank where a predetermined amount of money is fixed for a specific time period. Ad See 2022s 10 Best CD Accounts.

A certificate of deposit CD is a different type of savings vehicle that locks your interest rate for a set amount of time. Certificates of deposit CDs are a type of savings account that pay a fixed interest rate for a fixed period of time. Compare Rates Terms and Deposit Amounts.

The catch is that you have to keep your money in the account for a fixed amount of time. A trustee or trust corporation duly constituted under any written law. The longer the term the higher the APY.

A certificate of deposit is a type of deposit account that typically offers a higher APY annual percentage yield than a traditional savings account. The definition of a certificate of deposit is a low-risk investment sold by banks credit unions and thrift institutions. CDs provide an interest rate premium in exchange for locking up your money for a set period of time.

The NCUA uses its National. Statutory bodies incorporated under an Act of Parliament. A bond is a loan to a company or the government for a term that can.

Investment accounts could give you a higher rate of return of the three but often with greater risk of losing your money. A CD is a federally insured savings account for a term usually up to five years. When you cash in or redeem your CD you receive.

Certificates of deposit CDs are investments that help you grow your money safely and using them can be as simple or as complicated as you want. To withdraw early you usually pay a penalty. A certificate of deposit CD is a savings account that holds a fixed amount of money for a fixed period of time such as six months one year or five years and in exchange the issuing bank pays interest.

Break the CD before your term is up and in most cases you could cough up an early withdrawal penalty. Interest Earned in Savings Accounts vs. The Central Depository System is a system that is fully owned and operated by Bursa Malaysia Depository Sdn Bhd formerly known as Malaysian Central Depository Sdn Bhd a wholly owned subsidiary of Bursa Malaysia Berhad.

Understanding Certificate of Deposit. The Federal Deposit Insurance Corporation can insure CD balances of up to 250000 meaning you wont lose your money even if your bank falls on hard times as long as your bank carries FDIC insurance on its CDs. Open an Account Reasons to consider CDs.

But you can also add more complex strategies if you have specific goals or needs. For example if you open a three-year CD with 1 APY it will keep that same interest rate for the entire three years no matter what happens to interest rates overall. If your needs are basic its easy to put money into a CD and start earning more than you can earn in a savings account.

The national average APY for a one-year CD is 016 but you can find rates as high as 07 or 09. The good news is that money in a certificate of deposit is just as safe as it is in a savings account. See Todays High Rates From Multiple Online Banks.

Any society registered under the Societies Act 1966. CDs offer higher returns than savings accounts and more safety than investments such as stocks and mutual funds. An IRA CD is simply an IRA where all the money is invested in certificates of deposit CDs.

An IRA and a CD. A five-year CD has a national average rate of 029 but rates for these longer-term CDs can be found as high as 120. These days if youre looking for a place to stash your extra funds you have a lot of options.

IRA CDs may appeal to the risk-averse who want to. Central Depository System CDS CDS is an acronym for Central Depository System. The definition of certificate of deposit is an account that allows you to save money typically at a fixed interest rate for a fixed amount of timesay 6 months 1 year or 5 years.

Easily Compare Top Offers Apply.

/dotdash-money_market_savings-Final-6a3f125ef6c74528ab7be85ce42e468c.jpg)

Money Market Fund Vs Mma Vs Savings Account What S The Difference

What Is A Cds Account Dollarsandsense My

Certificate Of Deposit Cd All You Need To Know

What Is A Certificate Of Deposit Cd Definition Meaning Example

Certificate Of Deposit Cd What Is A Cd And How Does It Work

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-cbf2392d68a44e7484e66859449cc47c.jpg)

The Complete Guide To Checking Accounts

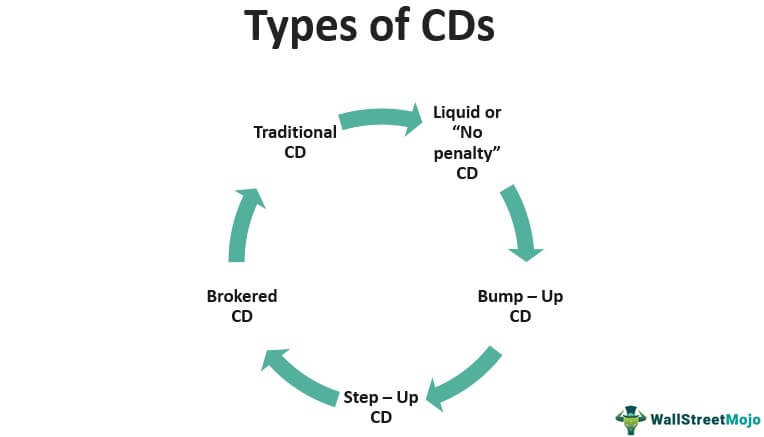

Certificate Of Deposit Cd Definition Types Examples

What Is A Cd How Does It Work Ally

/get-best-savings-interest-rates-you_round2_option2-ebf6fa7998384354b33e5b0b24cc0918.png)

Cds Vs Mmas Vs Savings Accounts Choosing The Right One

Certificate Of Deposit Cd Definition Types Examples

Certificate Of Deposit Cd Definition Types Examples

How Do Cds Work Learn How To Save Smarter Nerdwallet

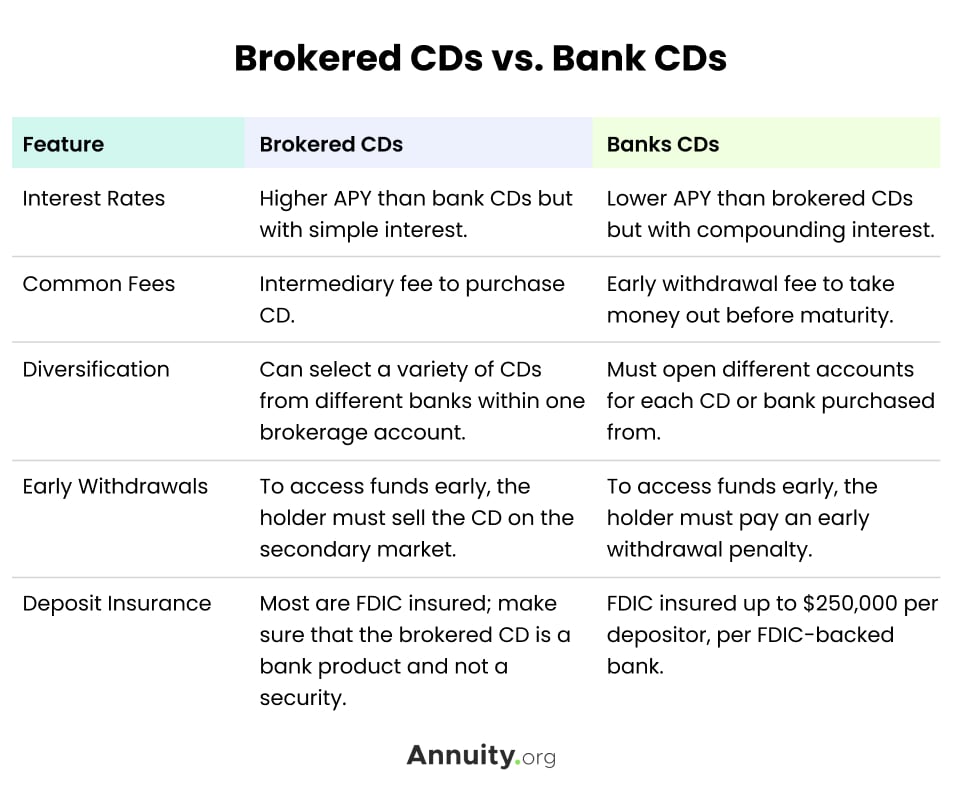

How Do Brokered Cds Work Pros Cons Purchasing

What Is Demat Account Meaning Types Advantages How To Open A Demat Account In India In 2021 Bond Funds Financial Asset Accounting

Money Market Accounts Vs Cds Understanding The Differences Marcus By Goldman Sachs

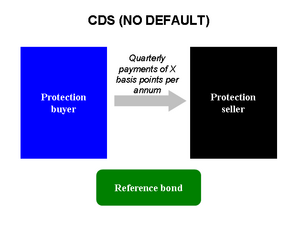

What Is A Credit Default Swap Cds Meaning And How They Work Ig Uk

Certificate Of Deposit Cd Definition